Mortgage Brokering in Ontario

Textbook Case Study

14th/15th Edition Case Study

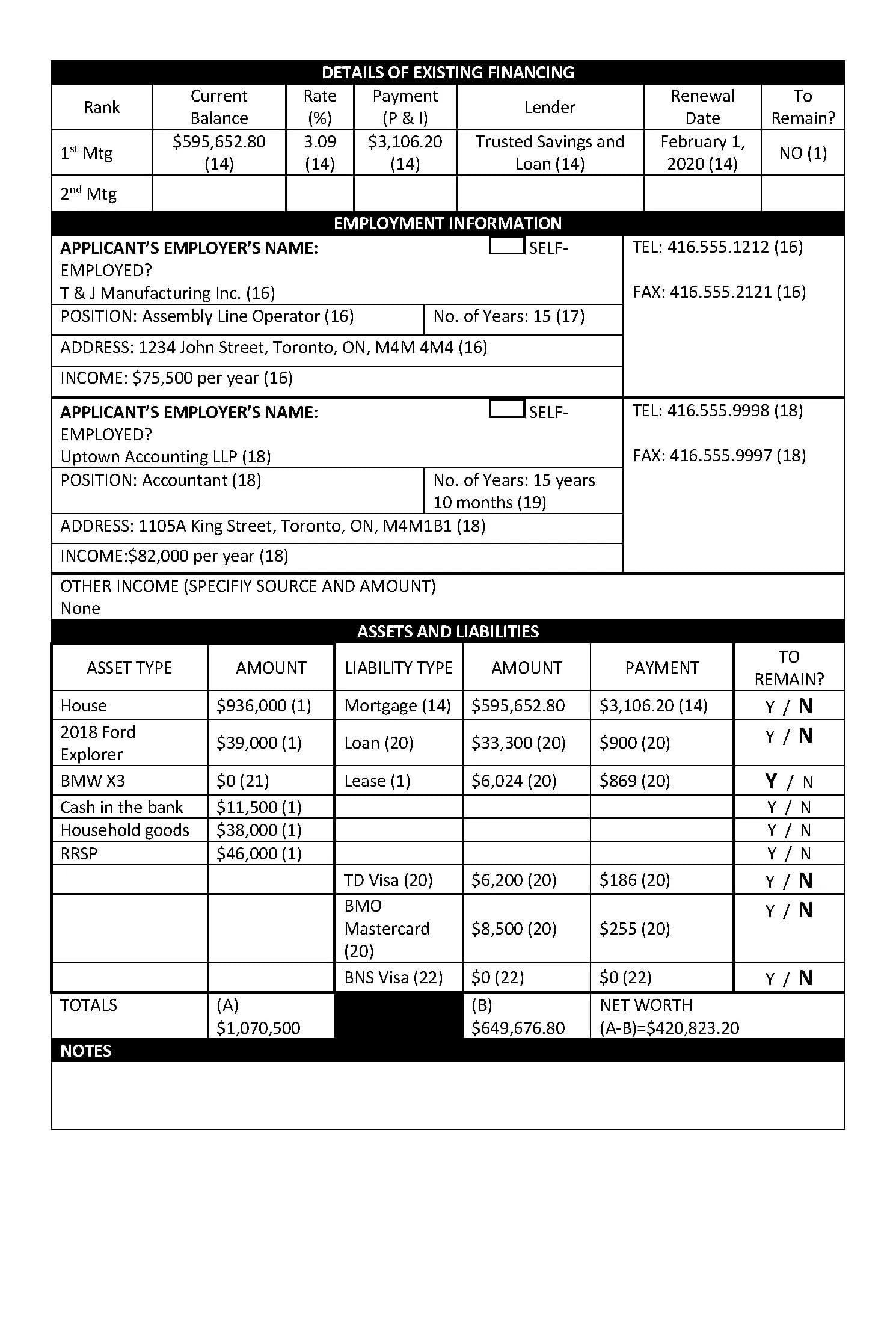

1. What question(s) should you ask this couple regarding their previous credit?

Why do they have late payments on the BMO MC? (found in the credit report, Trade Information Section)

2. When was their credit report first opened?

01/05/97 (found in the credit report, SINCE)

3. Who has a higher credit score?

Susan Adams does at 791 (found in the credit report, RISK SCORE)

4. When did they first get their TD Visa Card?

12/1997 (found in the credit report, TRADE INFORMATION SECTION, TD Visa, OPND)

5. Who has more credit?

Jack Adams. He has a BMW loan in addition to the joint credit that he has with Susan. While Susan also has a BNS Visa, there is zero balance. (found in the credit report, TRADE INFORMATION SECTION)

6. What do the following mean? (found in Chapter 14: Application Analysis – Borrower Credit, Equifax Credit Report Legend)

- MR Months Reviewed – the number of months that the creditor has reviewed the account

- DLA Date of Last Activity

- RPTD Reported

7. What two documents are required by the MBLAA to be left with your clients once they sign the Borrower Disclosure? (found in Chapter 18: Borrower Disclosure, section 18.5 Borrower Disclosure – How disclosure must be made)

a) Borrower Disclosure

b) Amortization Schedule

8. You have just learned that this couple has two children, one a 6-year-old daughter and the other a three-year-old son. Will this have any impact or effect on this application being approved by the Lender? Why or why not?

No. Expenses associated with children are not included in the GDS or TDS. (found in Chapter 13: Application Analysis – Application Ratios, section 13.2 Gross Debt Service (GDS) and Total Debt Service (TDS), TDS: Included and excluded items)

9. What is the amount of the finder’s fee, in dollars, that SuperBank will pay? (found in Chapter 1: Market Overview, section 1.2 A Career as a Mortgage Agent)

First, determine the mortgage amount.

80% (the loan amount from the Scenario) x $936,000 (the appraised value from the scenario)

.80 (80/100, which is 80% converted to a decimal) x $936,000 = $748,800

Now, multiply the finder’s fee of 85bps times the mortgage amount of $748,800

.0085 (b5bps expressed as a decimal) x $748,800 = $6,364.80

Therefore the amount of the finder’s fee is $6,364.80

10. In whose name does the Lender make the finder’s fee cheque payable? (found in Chapter 6: Transaction Overview, section 6.3 The Steps in a Brokered Transaction, 18. Receiving Commissions)

Sample Mortgages Inc.

11. Does SuperBank require the borrowers to pay their own property taxes or will they be included in their mortgage payment?

It is included in the mortgage payment (found in the Mortgage Commitment, Schedule A, Conditions, Property Taxes)

12. Does SuperBank require Title Insurance on this mortgage?

Yes (found in the commitment letter, Schedule A, Conditions)

13. Is SuperBank’s mortgage fully open, partially open or closed?

Partially open (found in the commitment letter, Schedule A, Prepayment Policies)

14. What are the prepayment privileges of SuperBank’s mortgage?

20% per year of the original amount (found in the commitment letter, Schedule A, Prepayment Policies)

15. How much is the default insurance premium for this mortgage?

There is no default insurance premium on this mortgage as this is a conventional mortgage (Mortgage Commitment, Loan)

1. The Borrower Disclosure requires that all costs associated with the mortgage be disclosed.

a) What are the exact costs that must be disclosed in this particular transaction?

- Lender’s Legal Fees: $1,950.00 (found in the lender’s commitment, Administration and Service Fees)

- Lender’s Fee: $550 (found in the lender’s commitment, Administration and Service Fees)

- Appraisal fee: $435 (found in the Case Study, Scenario and Supporting Documents)

- Title insurance fee: $809 (required as per lender’s commitment, Schedule A, Conditions. The amount is found in the Case Study, Scenario and Supporting Documents)

b) How does the cost of borrowing have to be disclosed (i.e. dollars and cents, a percentage, etc.)? The cost of borrowing must be disclosed in both dollars and cents and as a percentage. Refer to Chapter 18: Borrower Disclosure, Pause for clarification – The cost of borrowing: dollars and cents.

2. Describe the specific risks that must be disclosed to the borrower with regards to this (found in Chapter 18: Borrower Disclosure, section 18.2 Borrower Disclosure – What must be disclosed, 6. Risks associated with the proposed mortgage)

- This is a partially open mortgage: The commitment calls this an “open” mortgage but when looking at the prepayment policies you can see that it is partially open. Therefore, the risk is that upon early prepayment there will be a penalty. The IRD may be so large that it may not be financially worthwhile to refinance the mortgage during the term, or pay it off completely, even if possible.

- NSF Fee: If the borrower fails to have funds to make a payment and the payment is returned NSF, the fee is $150

- Standard Charge Terms: The borrower must abide by the Standard Charge Terms. Failure to meet the requirements of this document may result in penalties imposed by the lender. The borrower should ask their lawyer at closing to explain in detail the responsibilities contained in this document.

- All mortgages carry risk: Because this is a debt secured by your property, any failure to meet the obligations of this debt, including making payments and abiding by the standard charge terms may result in significant financial loss as well as the loss of your property.

3. How long before this mortgage transaction closes must the Borrower Disclosure document be provided to the borrower?

At least 2 business days before closing unless waived by the borrower in writing (found in Chapter 18: Borrower Disclosure, section 18.6 Borrower Disclosure – When disclosure must be made)

4. If the borrower decides to cancel the application after signing the Borrower Disclosure document, how much will the borrower owe you?

Nothing because the Borrower Disclosure is not a contract, only disclosure. The borrower is not legally bound by anything in this document. (found in Chapter 18: Borrower Disclosure, section 18.2 Borrower Disclosure – What must be disclosed, Pause for clarification – Borrower disclosure is NOT a contract)

5. You are at the point in the borrower disclosure where you are explaining the cost of borrowing. How would you explain it? (found in Chapter 18: Borrower Disclosure, section 18.3 Cost of Borrowing – Expanded explanation)

Anything similar to, “When the total cost of borrowing is expressed as a percentage this means the total of all costs, payable up front or over the term of the mortgage, combined with the rate of interest being charged during the term, expressed as a percentage. When the total cost of borrowing is expressed in dollars and cents this means the total of all costs, payable over the term of the mortgage, expressed in dollars and cents. “

6. Is the NSF included in the cost of borrowing? Explain your answer.

No, the NSF (non-sufficient funds) is a fee that would be charged if the borrower’s mortgage payment is returned as NSF. Therefore, this is not a payment that is made to obtain the mortgage. (found in Chapter 18: Borrower Disclosure, section 18.3 Cost of Borrowing – Expanded Explanation, Cost of Borrowing – Included and excluded costs)

7. Must the prepayment privileges be disclosed in the Borrower Disclosure document? Explain your answer.

Yes (found in Chapter 18: Borrower Disclosure, section 18.2 Borrower Disclosure – What must be disclosed, 7. Terms and conditions of the proposed mortgage)

8. Does the number of lenders that your brokerage represented last year have to be disclosed? Explain your answer.

Yes (found in Chapter 18: Borrower Disclosure, section 18.2 Borrower Disclosure – What must be disclosed, 4. The number of lenders the brokerage represented during the previous year)

9. Does the Investor/Lender disclosure have to be completed in this transaction? Explain your answer.

No, because the lender is an institution (found in Chapter 17: Submitting the Application and Obtaining a Commitment, section 17.2 Investor/Lender Disclosure)

10. Do the conditions as listed in the commitment letter have to be included in the Borrower Disclosure document? Explain your answer.

Yes (found in Chapter 18: Borrower Disclosure, section 18.2 Borrower Disclosure – What must be disclosed, 7. Terms and conditions of the proposed mortgage)

PLEASE NOTE: ALL CALCULATIONS MUST BE BASED ON THE MORTGAGE APPROVAL

1. Based on SuperBank’s approval, what is the total amount of this proposed mortgage?

Mortgage Amount = ltv x property value

Mortgage Amount = 80% x $936,000

Mortgage Amount = .80 x $936,000

Mortgage Amount = $748,800

2. GDS Calculation. Based on SuperBank’s approval and the clients’ income, what is their GDS? (found in Chapter 13: Application Analysis – Application Ratios, section 13.2 Gross Debt Service (GDS) and Total Debt Service (TDS) Ratios, Calculating the Gross Debt Service Ratio (GDS))

GDS = [(PITH + ½ Condo Maintenance fee) / Gross Income] x 100

GDS = ((($3,543.67 x 12 Mortgage Payment) + ($424.75 x 12 Taxes) + ($100 x 12 Heat)) / ($75,500 + $82,000)) x 100

GDS = (($42,524.04 + $5,097.00 + $1,200) / $157,500) x 100

GDS = ($48,821.04/$157,500) x 100

GDS = (0.3099748571428571) x 100

GDS = 31% (rounded off)

3. TDS Calculation. Based on SuperBank’s approval and the clients’ income, what is their TDS? (found in Chapter 13: Application Analysis – Application Ratios, section 13.2 Gross Debt Service (GDS) and Total Debt Service (TDS) Ratios, Calculating the Total Debt Service Ratio (TDS): Verifying)

TDS = [(PITH + ½ Condo Maintenance fee + Other Debts) / Income] x 100

GDS = [(($3,543.67 x 12 Mortgage Payment) + (424.75 x 12 Taxes) + (100 X 12 Heat) + ($869 x 12 BMW Lease)) / 157,500] x 100

The other debts are NOT included in the TDS because they are being paid off.

TDS = (($42,524.04 + $5,097.00 + $1,200 + $10,428) / $157,500) x 100

TDS = ($59,249.04 / $157,500) x 100

TDS = 0.376184380952381 x 100

Now we multiply the answer by 100 to convert the decimal to a percentage.

TDS = 37.62 rounded off